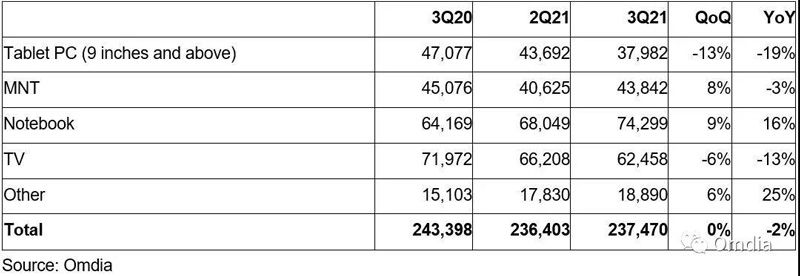

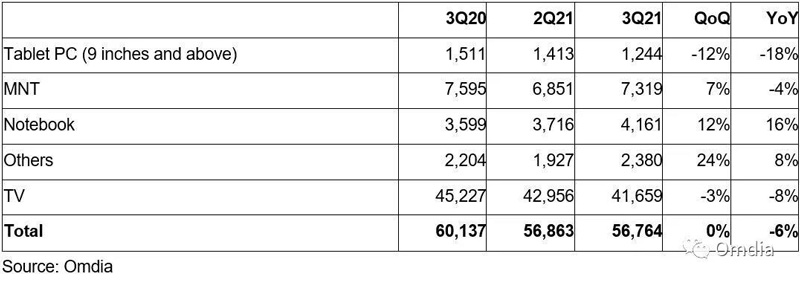

According to Omdia’s Large Display Panel Market Tracker — September 2021 Database, preliminary findings for the third quarter of 2021 show that shipments of large TFT LCDS amounted to 237 million units and 56.8 million square meters, as shown in Tables 1 and 2.

That marked shipments were flat quarter-on-quarter and down year-over-year despite strong seasonal demand. Shipments of 9-inch and larger tablets and LCD TV panels fell significantly in the quarter.

Shipments of display panels for tablets 9 inches or larger were down 13 percent month-on-month and 19 percent year-over-year, while shipment area was down 12 percent month-on-month and 18 percent year-over-year. In terms of LCD TV display panels, shipments were down 6 percent month-on-month and 13 percent year-over-year, while shipment area was down 3 percent month-on-month and 8 percent year-over-year. In contrast, there was still strong demand for LCD panels for notebook computers, with shipments up 9% Q/Q and 16% Y/Y, and shipments by area up 12% Q/Q and 16% Y/Y.

Shipments of LCD desktop display panels are not as good as those of laptops, While its unit shipments and shipment area rose 8 percent and 12 percent, respectively, from the previous month, both shipments were still down year over year.

Table 1: Preliminary Survey Results of Large-size TFT LCD Shipments in Q3 2021 (thousands)

Table 2: Preliminary Survey Results of Large-size TFT LCD Shipment Area in Q3 2021 (thousands of square meters)

The decline in tablet display panel shipments was largely due to slowing consumer demand. Consumer demand for tablets for entertainment and educational purposes has continued to be strong during the pandemic. However, recently demand is weakening because most consumers have already bought tablets. Business demand for tablets, while rising, is still lower than demand for laptops.

Instead, demand for display panels for laptops remains strong, as business demand for laptops is high as many companies look to replace desktops with laptops. However, consumer demand for laptop terminals declined slightly. Shipments of laptop display panels also saw double-digit quarterly and year-over-year growth in the third quarter of 2021. This is thanks to increased commercial demand for laptops, which are concentrated in sizes 14 inches and up. Business demand offsets the decline in consumer demand (especially for children’s home schooling), which is concentrated on smaller screens like the 11.6-inch Chromebook.

LCD desktop display panel shipments and area continued to grow on a sequential basis, but declined year-on-year. As with laptop display panels, consumer demand for LCD desktop display panels has declined while business demand has increased. In general, business demand is stronger than consumer demand for desktop displays. Even during the pandemic, consumer demand for desktop displays is strong for home entertainment, working from home and studying at home.

However, laptops are replacing desktops and desktop monitors increasingly. Unlike laptop display panels, commercial requirements limit the size migration of desktop displays. The consumer market for tabletop displays has boosted shipments of large-size displays (27 inches or more) and high-end gaming displays. However, the commercial market needs cheap, low-end monitors with screen sizes between 19 and 24 inches.

The shipment quantity of LCDTV panel appeared on unit and area sequential and year-on-year decline. During the pandemic, the price of LCD TV display panels rose sharply, and subsequently increased the price of LCD TVS. Even so, consumers continue to buy LCD TVS because of pent-up and pulled demand, especially in developed regions. Because of the shortage of key components for televisions and display panels and global logistics delays, retailers and brands sought inventory. However, LCD panel buyers cut back on display panel purchases in the third quarter of 2021, putting price pressure on display panel manufacturers as demand for LCD TVS in the end market gradually weakened. As a result, display panel manufacturers began to reduce their LCD TV plant utilization in the middle of the third quarter. LCD TV panel prices began to fall freely in the third quarter and will continue to fall in the fourth quarter.

As LCD TV panel prices drop and large-size TFT LCD shipments decline, Its revenue fell 1% in the third quarter of 2021, though it was still up 24% year-over-year. Display panel manufacturers apparently enjoyed higher display panel prices until the second quarter of 2021, more than a year after the outbreak began. However, starting in the third quarter, as retailers and brands completed their inventories, they faced strong price pressures as end-market demand slowed. Once LCD TV display panel prices start to erode, LCD desktop display panel prices will soon follow.

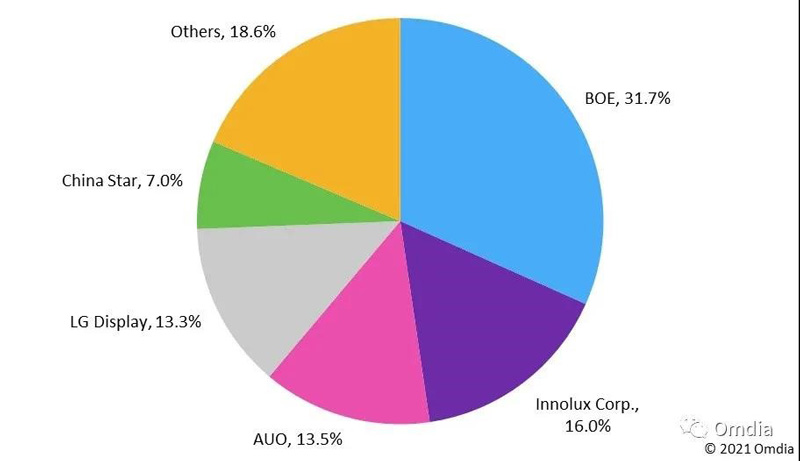

In the third quarter of 2021, mainland Chinese vendors accounted for the largest share of unit shipments and area shipped, 49% and 57% respectively

As shown in Table 1 below, mainland Chinese vendors accounted for the largest share of large-size TFT LCD shipments in the third quarter. BOE led the pack with 32 percent, followed by Innolux with 16 percent and AU Optronics with 13 percent. Display panel makers in Mainland China accounted for 49% of large-size TFT LCD shipments, followed by Taiwan with 31%. South Korean display panel makers expanded their TFT LCD production, but maintained a 14 percent share in the third quarter. In large size TFT LCD shipment area, BOE also had the largest share in the third quarter, at 27 percent, followed by CSOT with 16 percent and LG Display with 11 percent. Chinese display panel makers accounted for 57 percent of large-size TFT LCD shipments, followed by Taiwan with 22 percent and South Korea with 13 percent.

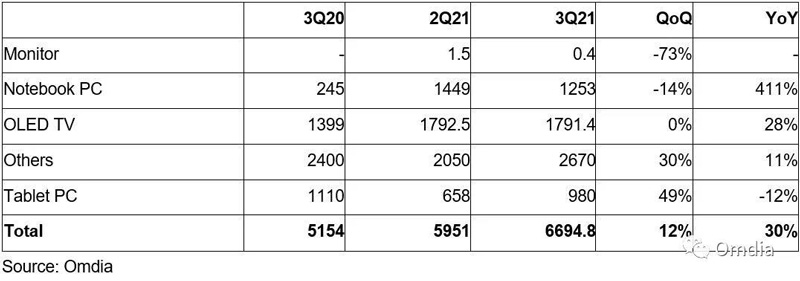

Large-size OLED display panel shipments continued to maintain double-digit growth

According to Omdia’s preliminary survey results for the third quarter of 2021, shipments of large-size OLEDs grew by double digits both year-on-year and quarter-on-quarter. Samsung Display led the growth in OLED laptop display panel shipments, while LG Display led the growth in OLED TV display panels. This is because people are keen to spend more money on high-end products during the pandemic. In the third quarter of 2021, South Korean display panel makers accounted for 78 percent of total large-size OLED shipments, followed by Chinese display panel makers with 22 percent. In the third quarter of 2021, LG Display continued to capture 100 percent of OLED TV display panel shipments, while Samsung Display captured 100 percent of OLED display panel shipments for notebook computers. In the second quarter of 2021, South Korean display panel makers accounted for 88% of total large-size OLED shipments, while Chinese display panel makers accounted for 12%. However, In the third quarter of 2021, Chinese display panel manufacturers and Everdisplay Optronics Co., Ltd took the largest share of OLED tablet display panel shipments at 59 percent, followed by Samsung Display. In the same quarter, Tianma also had a 34% share of OLED display panel shipments for other applications. In short, Chinese display panel makers are increasing their penetration in large-size OLED display panel shipments.

Table 2: Preliminary Survey Results of Large-size TFT LCD Shipment Area in Q3 2021 (thousands of square meters)

Post time: Nov-23-2021