It took about 50 years for the mainstream display technology to change from picture tubes to LCD panels. Reviewing the replacement of last display technology, the main driving force of emerging technology is the increasing demand of consumers, while the core of the emerging technology commercializing development is still the price.

We believe that with the support of mini-LED backlighting and other technologies, LCD panels will be able to meet consumers’ new demand for high definition and large-screen display. Considering that the emerging technology yield, cost and other problems are difficult to solve in short term, LCD panel is expected to be still the main technology in the display field in the coming 5 to 10 years.

Challenge: Emerging technology development and bottleneck

The demand of display industry is mainly portable, flexible, large size and high definition. At present, the emerging technology explored by major manufacturers mainly includes OLED, Micro-LED direct display and other technologies.

Although Micro-LED is with high display performance, it still take time to be commercialized. Micro-led is a research hotspot in the display industry and one of the most promising display technologies in the future. However, there are technical difficulties such as mass transfer, package testing, full color, uniformity, etc., which are still in the research and development stage and still several years away from commercial mass production.

OLED technology is gradually being commercialized and used in small size areas such as watches and mobile phones etc…OLED, also known as organic light-emitting diode (OLED), is characterized by low power consumption, high contrast, flexibility and relatively simple process through self-illumination imaging. Currently, OLED displays are mainly foldable screens represented by active matrix AMOLED that carry smart phones.

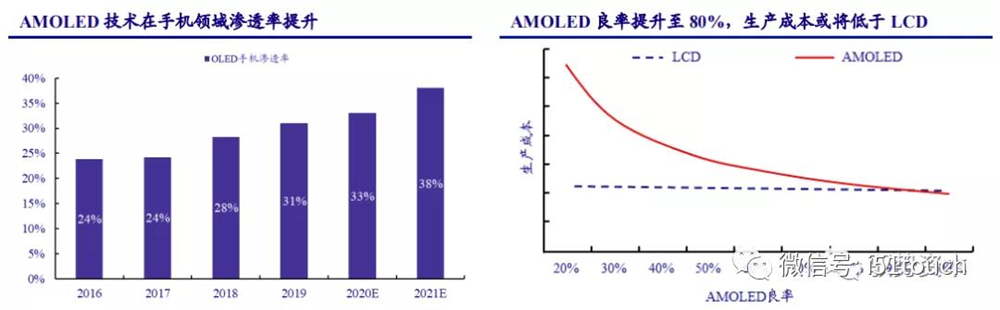

There is still a price gap between AMOLED and LCD phone panels due to depreciation, labor costs and other expenses. The cost of AMOLED may be lower than that of LCDS, with yields of more than 80 percent, according to Intelligence Research. As yields improve, Trendforce expects AMOLED mobile phone penetration to increase from 31% in 2019 to 38% in 2021, with AMOLED mobile phone penetration expected to exceed 50% in 2025.

It took about 50 years for the mainstream display technology to change from picture tubes to LCD panels. Reviewing the replacement of last display technology, the main driving force of emerging technology is the increasing demand of consumers, while the core of the emerging technology commercializing development is still the price.

We believe that with the support of mini-LED backlighting and other technologies, LCD panels will be able to meet consumers’ new demand for high definition and large-screen display. Considering that the emerging technology yield, cost and other problems are difficult to solve in short term, LCD panel is expected to be still the main technology in the display field in the coming 5 to 10 years.

Challenge: Emerging technology development and bottleneck

The demand of display industry is mainly portable, flexible, large size and high definition. At present, the emerging technology explored by major manufacturers mainly includes OLED, Micro-LED direct display and other technologies.

Although Micro-LED is with high display performance, it still take time to be commercialized. Micro-led is a research hotspot in the display industry and one of the most promising display technologies in the future. However, there are technical difficulties such as mass transfer, package testing, full color, uniformity, etc., which are still in the research and development stage and still several years away from commercial mass production.

OLED technology is gradually being commercialized and used in small size areas such as watches and mobile phones etc…OLED, also known as organic light-emitting diode (OLED), is characterized by low power consumption, high contrast, flexibility and relatively simple process through self-illumination imaging. Currently, OLED displays are mainly foldable screens represented by active matrix AMOLED that carry smart phones.

There is still a price gap between AMOLED and LCD phone panels due to depreciation, labor costs and other expenses. The cost of AMOLED may be lower than that of LCDS, with yields of more than 80 percent, according to Intelligence Research. As yields improve, Trendforce expects AMOLED mobile phone penetration to increase from 31% in 2019 to 38% in 2021, with AMOLED mobile phone penetration expected to exceed 50% in 2025.

Thirdly, OLED lacks cost competitive advantage compared with LCD. According to IHS Smarkit, the current market is dominated by 49-60-inch mainstream panel sizes. Taking 55-inch ULTRA-high-definition OLED as an example, the manufacturing cost of OLED panels with only 60% yield is about 2.5 times that of TFT-LCD of the same size. In the short term, due to the high technical barriers of the two key steps of sublimation purification and vacuum distillation, OLED cannot quickly improve the yield of good products.

For large-size OLED panels, the manufacturing cost is still about 1.8 times that of TFT-LCD of the same size, even if the yield reaches 90% or more. Considering that depreciation is also an important factor of cost, after the depreciation of OLED factory, the cost gap of 60% yield rate will still be 1.7 times, and will be reduced to 1.3 times when the yield rate is 90%.

Despite the capacity expansion trend and performance advantages of OLED in the small and medium screen segment, OLED still has technology and capacity constraints in 3-5 years in the large-size segment, compared to TFT-LCD. The combined future shipments of Samsung and LGD, which have invested heavily in the technology, will not exceed 10% of global TV panel demand, which is still far behind TFT-LCD shipments.

New opportunities: Mini – LED backlight technology brings growth opportunities to LCD

LCD technology has obvious advantages over OLED technology in terms of cost and longevity. It has a small difference in color gamut, resolution and power consumption, and is inferior in contrast and motion image blur. Although OLED has excellent picture quality, its self-luminous display technology is recognized as the new development direction of the display industry in the future. While the material stability and encapsulation technology of OLED still need to be improved. Compared with traditional backlight LCD which has been developed and mature, the cost still has room for further reduction.

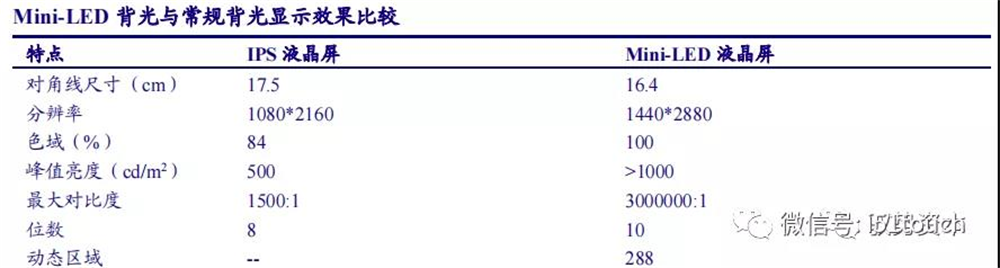

The appearance of mini-LED has changed the passive situation of LCD. The addition of mini-LED backlight technology greatly improves LCD performance, and directly competes with OLED in all aspects of non-flexible display performance. Since the Mini – LED has local dimming technology, high dynamic contrast and wide color gamut display can be realized through dynamic dimming of the whole picture. Through the special encapsulation structure and craft, the light angle can be increased and the halo effect can be weakened, to make nearly zero OD design realized in the terminal with uniform self-mixing effect and realize the lightness of the whole machine and achieve the same effect as OLED display.

As an LCD backlight technology, Mini-LED presents several advantages: high dynamic contrast, high dynamic range, the number of dimming areas depends on LCD screen size, on/off distance and resolution.

According to LEDinside, if LCD competes directly with OLED, the product life cycle will be about five to 10 years, and if mini-LED is added to enhance LCD performance, the product life cycle will be increased by 1.5 to two times.

We believe that the combination of Mini-LED and LCD can expand the life cycle of existing LCD products and strengthen the differentiated bargaining power of panel manufacturers. It is expected that mini-LED backlit LCD screens will be widely used in high-end notebook, e-sports display and large-size TV products from 2021.

LCD panel is a typical technology – intensive and capital – intensive industry. Due to the mismatch of supply and demand caused by the 2-year construction period of new production line and the 1-year capacity climbing period, the industry shows a strong periodicity. We think, as the industry matures, the manufacturer’s new capacity will significantly reduce. Against the background of that the demand side stably growing and supplying side with steady capacity, the industry supply and demand pattern is improved, periodic will be significantly diminished, panel prices will remain in a reasonable range, and the profitability of the LCD panel makers would increase greatly.

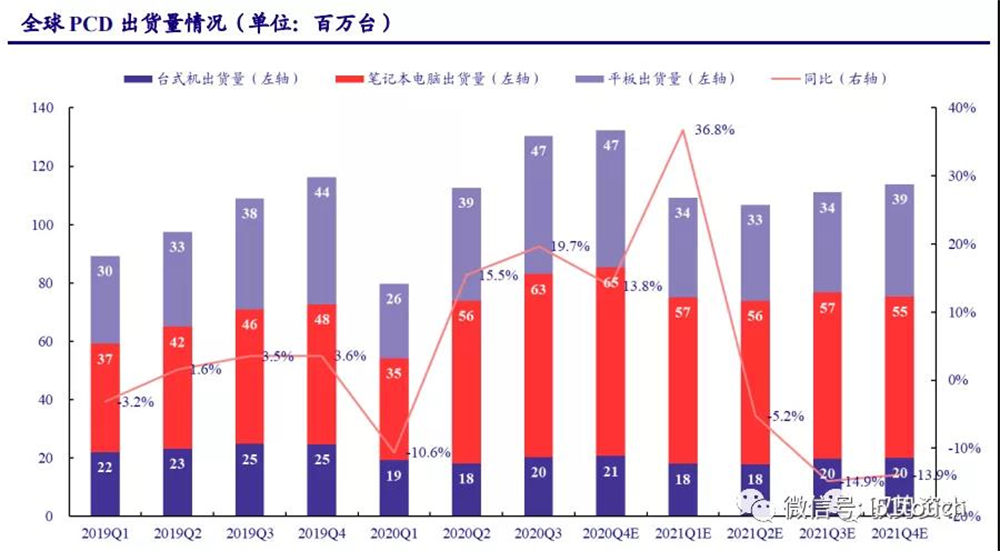

PCD is in great demand under the housing economy, so new products bring LCD new space. In IT, the demand for mid-size laptops is strong under the “home economy”. Although the novel coronavirus disease (COVID-19) suppressed consumer demand in the first quarter of 2020, the demand of users to take classes and work at home increased during the epidemic period. Since the second quarter of 2020, PCD shipments have rebounded sharply: according to IDC statistics, global PCD shipments reached 130 million units in Q3 2020with a year-on-year growth of 19.7%, hitting a 10-year high.

Among them, notebooks and tablets are important growth points in the PCD market, with global shipments of 0.63/47 million units in Q3 2020 respectively, up 36% and 25% year-on-year respectively. The recurrence of COVID-19 and consumption stimulus policies of various countries are expected to further stimulate market demand. Global computer shipments are expected to grow by 14% year-on-year in 2020 Q4, with a total shipment of about 455 million units in 2020, up 10.47% year-on-year. IDC forecasts that global computer shipments will gradually return to around 441 million units starting in 2021 when the pandemic begins to subside.

We calculated according to the scenario in which the COVID-19 pandemic gradually eased in 2021. In 2021, LCD shipments are expected to return to 1.14 million units for LCD, 2.47 million units for notebook and 94 million units for tablets. LCD shipment growth is expected to recover to around 1% in 2022-2023. Notebook shipments may gradually return to long-term averages from high levels. Growth in TABLET LCD shipments is expected to remain at 1.5%, taking into account the boost in tablet demand from emerging technologies such as mini-LED backlighting.

According to the Strategy Analytics and NPD Display Research reports, according to the average size of LCD monitors, notebook and tablet computers increase by 0.33 inch, 0.06 inch and 0.09 inch each year respectively, and the screen ratio is 4:3, the global shipment area of IT LCD panels is expected to reach 29 million square meters by 2023, with a compound growth rate of 1.02% from 2020 to 2023.

Even if the overseas capacity withdrawal plan is extended indefinitely, its existing capacity accounts for about 2.23%, and industry supply and demand will remain below the equilibrium line.

Price: cyclical weakening, is expected to stabilize in a reasonable range

Inventory cycle maintains low, and large size panel prices continue to pick up. In early 2020, due to the impact of the COVID-19 pandemic, the global TV demand decreased, which impacted the previously expected growth logic of the market, and the panel demand decreased. In the second half of the year, the panel inventory has been effectively reduced, and the inventory cycle remains at a low level of about one week. The demand for large-size panels has gradually picked up, but the supply of panel capacity has decreased, so the price has continued to rise.

Medium size panel prices pick up. In 2019, PCD demand fell from its high, leading to a decline in mid-size panel prices. Notebook panel prices have been rising since February due to a surge in demand for laptops in 2020. And the price continues to rise in 2021 with increasing percentage.According to Wind data statistics, in January 2021, 14.0-inch notebook panel prices increased 4.7% month-on-month. In our view, notebook PC demand remains strong in 2021, and there is still some room for notebook panel prices to rise.

We believe the cyclical nature of panel prices will gradually diminish as industry supply and demand patterns improve. Specifically, as the demand for mobile phone terminals pick up, small panel prices are expected to continue to repair. In 2021, the demand for notebooks remains high, so prices for mid-size panels are expected to continue to rise. Because of the continuous withdrawal of overseas panel production capacity and the recovery of TV demand, It is expected that the rising trend of large size panel prices is expected to maintain until 2021H1. And panel price increases are expected to significantly improve the profitability of panel manufacturers.

Post time: Dec-25-2021