Through the unremitting efforts of panel manufacturers, the global panel production capacity has been transferred to China. At the same time, the growth of China’s panel production capacity is amazing. At present, China has become the country with the world’s largest LCD production capacity.

Facing the unique LCD competitive advantage of domestic manufacturers, Samsung and LGD manufacturers have announced that they will withdraw from the LCD market. But the outbreak of the epidemic has caused a mismatch between supply and demand. In order to ensure the normal supply of panels for their terminal products, both Samsung and LCD announced a delay in the closure of LCD production lines.

Panel is the leader of Optoelectronic industry, LCD and OLED are mainstream products

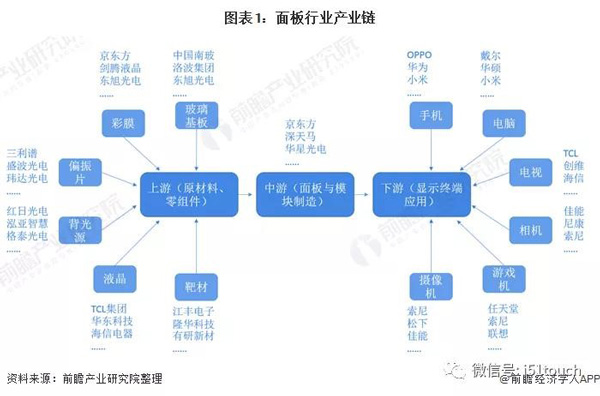

The panel industry mainly refers to the touch display panel industry for electronic devices such as TELEVISIONS, desktop computers, laptops and mobile phones. Nowadays, information display technology plays an increasingly important role in people’s social activities and daily life. 80% of the acquisition of human information comes from vision, and the interaction between terminal devices of various information systems and people needs to be realized through information display. So panel industry has become the leader of the optoelectronics industry, next only to the microelectronics industry in the information industry, and has become one of the most important industries. From the perspective of industry chain, panel industry can be divided into upstream basic materials, midstream panel manufacturing and downstream terminal products. Among them, the upstream basic materials include: glass substrate, color film, polarizing film, liquid crystal, target material, etc.; Midstream panel manufacturing includes Array, Cell and Module; Downstream end products include: TELEVISIONS, computers, mobile phones and other consumer electronics.

At present, the two main products in the panel market are LCD and OLED respectively. LCD is superior to OLED in price and service life, while OLED is superior to LCD in blackness and contrast. In China, LCD accounted for about 78% of the market in 2019, while OLED accounted for about 20%.

Global panel transfer to China, China’s LCD production capacity ranks first in the world

Korea took advantage of the trough of the liquid crystal cycle in the mid-1990s to expand rapidly and overtook Japan around 2000. In 2009, China’s BOE announced the construction of 8.5 generation line, breaking the technical blockade between Japan, South Korea and Taiwan. Then Sharp, Samsung, LG and other Japanese and South Korean companies decided to build 8 generation lines in China at an amazing speed. Since then, the LCD industry in mainland China has entered a decade of rapid expansion. After the development of recent years, China’s panel industry is coming from behind. In 2015, China’s LCD panel production capacity accounted for 23% of the world. Along with The Korean manufacturers have announced to withdraw from LCD and turn to OLED, Global LCD production capacity further gathered in mainland China. By 2020, China’s LCD production capacity had ranked the first in the world, with the Chinese mainland producing about half of the world’s LCD panel.

China continues to lead the world in the surprising growth of panel production capacity

In addition, with the acceleration of production capacity release of multiple LCD G8.5/G8.6, G10.5 generation line and OLED G6 generation line, China’s LCD and OLED production capacity has maintained high growth, which is far ahead of the global panel capacity growth. In 2018, the growth rate of China’s LCD panel production capacity even reached 40.5%. In 2019, China’s LCD and OLED production capacity reached 113.48 million square meters and 2.24 million square meters, with Year-on-year growth 19.6% and 19.8% respectively.

Competition pattern — BOE’s acquisition of PANDA will further stabilize the leading position in LCD.

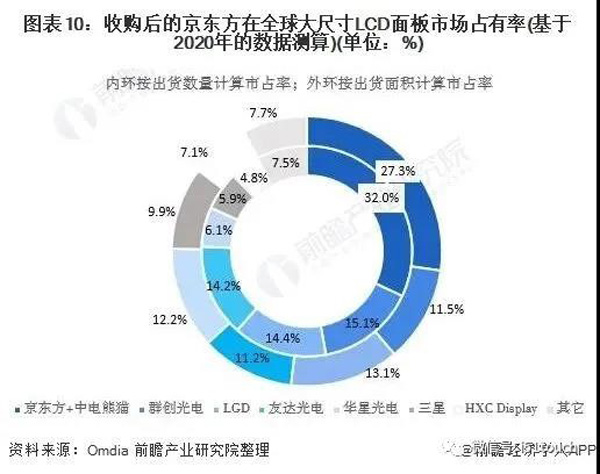

In fact, the competitive landscape of the global LCD market has changed significantly since LCD production capacity shifted from South Korea and Taiwan to The Chinese mainland. Recently, BOE has become the world’s largest supplier of LCD panels. No matter in terms of the supply quantity or supply area of the large size LCD panel, BOE accounted for more than 20% of the global market in 2020. And, in the middle of 2020, BOE announced that it would acquire CLP Panda. With the completion of the acquisition of PANDA production line of CLP in the future, BOE’s market position in LCD field will be further highlighted. According to Omdia, BOE’s shipment share in large-size LCD will reach to be 32% after the acquisition, and the LCD area of shipments would be accounted for 27.3% of the market.

At present, Chinese LCD manufacturers are also working mainly in the further layout of high generation LCD. From 2020 to 2021, BOE, TCL, HKC and CEC will successively put into production with 8 important production lines of more than 7 generations in Mainland China.

The OLED market is dominated by Samsung, and domestic manufacturers are actively proceeding layout.

The OLED market is currently dominated by Korean manufacturers. Samsung’s mature AMOLED technology and abundant production capacity have a definite advantage, so their strategic cooperation with the brand was further deepened in 2019. According to the statistics of Sigmaintell, Samsung’s OLED market share reached 85.4% in 2019, among which Flexible OLED has a market share of 81.6%. However, In recent years, Chinese manufacturers are also active in the OLED market, especially in flexible products. BOE currently has six OLED production lines under construction or under construction.

Post time: Sep-28-2021